How To Manage Your Finance Conveniently

Recently, banks and brokerage companies have increasingly invested in fin-tech, designed to make it easier for a private investor to access the stock or foreign […]

How Brexit Could Affect Your Property Investments

Brexit has been a topic of intense discussion and speculation, especially in the realms of economics and real estate. For investors holding or considering property […]

New Strategies for Finding the Best Investment Opportunities

Identifying Investment Niches Investing can be a great way to grow your wealth, but it is important to identify the right opportunities. One of the […]

What Are the Benefits of Investing in Precious Metals?

Advantages of Precious Metals as an Investment Precious metals can be a great addition to any investment portfolio. Investing in gold, silver, platinum, and palladium […]

Exploring the Benefits of Investing in Real Estate

Advantages of Investing in Real Estate Investing in real estate has long been seen as a smart way to build wealth. Real estate investments can […]

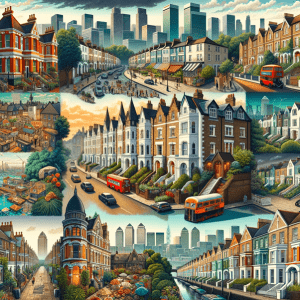

How Brexit Could Affect Your Property Investments

How Brexit Could Affect Your Property Investments

Brexit has been a topic of intense discussion and speculation, especially in the realms of economics and real estate. For investors holding or considering property for sale, understanding the potential impacts of Brexit is crucial. This article delves into the various ways Brexit could influence property investments in the UK.

Market Fluctuations and Property Values

One of the immediate effects of Brexit is the potential for market fluctuations. The uncertainty surrounding trade deals, immigration policies, and economic stability can lead to volatility in the property market. For investors, this could mean fluctuations in property values. In some cases, there might be a dip in prices, offering opportunities for buyers. Conversely, certain areas might see an increase in demand and prices, particularly if they become hotspots for businesses relocating due to Brexit.

For those looking at new build apartments, it’s important to keep a close eye on market trends. London, being a global city, might react differently to Brexit compared to other parts of the UK. The demand for property in the capital, driven by factors like employment opportunities and lifestyle, could sustain or even increase property values in the long term.

Rental Market Dynamics

Brexit could also impact the rental market, which is a key consideration for property investors. Changes in immigration policies may affect the number of people moving to the UK for work or study, which in turn influences demand for rental properties. Areas with a high population of EU nationals might see changes in rental demand.

However, it’s not all about potential declines. Some areas might see an increase in rental demand due to factors like relocation of businesses or workers within the UK. For those looking at new build apartments in London, staying informed and adaptable is key. Investors should stay informed about these dynamics to make strategic decisions about where to invest in rental properties.

Regulatory Changes and Investment Opportunities

Brexit brings with it the possibility of regulatory changes in the property market. This could include alterations in property taxes, landlord regulations, or planning permissions. While change can be challenging, it can also open up new opportunities. For instance, changes in planning laws could make it easier to develop or convert properties, potentially benefiting investors.

Investors should also be aware of the broader economic impacts of Brexit. For example, changes in trade agreements and economic policies could influence the overall economic health of the UK, which in turn affects the property market. Staying abreast of these changes is crucial for making informed investment decisions.

Brexit presents both challenges and opportunities for property investors. Market fluctuations, changes in the rental market, and regulatory shifts are all factors to consider. While uncertainty can be daunting, it also brings opportunities for savvy investors to capitalize on market changes. As with any investment, a well-researched, strategic approach is essential to navigate the post-Brexit property landscape.

How to Make Smart Decisions When Investing in Cryptocurrency

Cryptocurrency has become a popular investment option for those looking to diversify their portfolios and increase their returns. But investing in crypto is not without […]

Investing in Stocks: What You Need to Know

Benefits of Investing in Stocks Investing in stocks can be a great way to build wealth and diversify your portfolio. Stocks often offer higher returns […]

What Are the Different Types of Alternative Investments?

Investors looking to diversify their portfolios beyond stocks and bonds may consider alternative investments. Alternative investments are those that fall outside the traditional asset classes […]

How to Create a Diversified Investment Portfolio

4. Common Types of Investments Understanding the Basics of Diversification Diversification is an important investment strategy involving the spread of risk among different assets. It […]

Understanding Mutual Funds and ETFs: What You Should Know

Difference Between Mutual Funds and ETFs Understanding the difference between mutual funds and ETFs is the first step in making an informed decision when it […]

How to Manage Risk and Maximize Returns in Investing

Understand the Basics of Investing Investing involves taking on risk in order to make a return. It’s important to understand the basics before you begin […]

How to Choose the Right Investment Vehicle for Your Goals

4. Consulting a Financial Advisor Investing is one of the most important steps one can take toward building personal wealth and achieving financial security. Knowing […]

How to Find the Right Financial Advisor for Your Needs

Identifying Your Financial Goals Managing your finances is a critical part of ensuring a secure financial future. Whether you are looking to save for retirement, […]

How to Identify and Avoid Investment Scams

Warning Signs of Investment Scams Investment scams come in many forms and can be difficult to spot. It is important to be aware of the […]

What Are the Pros and Cons of Investing in REITs?

Overview of REITs Real Estate Investment Trusts (REITs) are publicly-traded securities that allow investors to buy into a portfolio of real estate-related investments, such as […]

Understanding the Basics of Investing for Retirement

Retirement investing can be an intimidating concept. There are so many options, rules, and strategies to consider. It can be difficult to know where to […]

What Is Value Investing and How Can It Help You?

4. How to Get Started with Value Investing What is Value Investing? Value investing is an investment strategy that focuses on buying stocks and other […]

What Are the Benefits of Investing in Commodities?

Factors to Consider Before Investing in Commodities Investing in commodities is a great way to diversify your portfolio and make a profit. But before you […]

What Is a Hedge Fund and How Does It Work?

Hedge funds are speculative investment funds that are not subject to the same regulations that apply to other investments. They are typically managed by professional […]

The Pros and Cons of Investing in Bonds

Benefits of Investing in Bonds Bonds are a popular and relatively safe way to invest. They have the potential to generate steady income and can […]