Advantages of Precious Metals as an Investment

Precious metals can be a great addition to any investment portfolio. Investing in gold, silver, platinum, and palladium can provide investors with a variety of benefits. Precious metals are a hedge against inflation, help diversify an investment portfolio, and can be a safe haven in times of economic uncertainty.

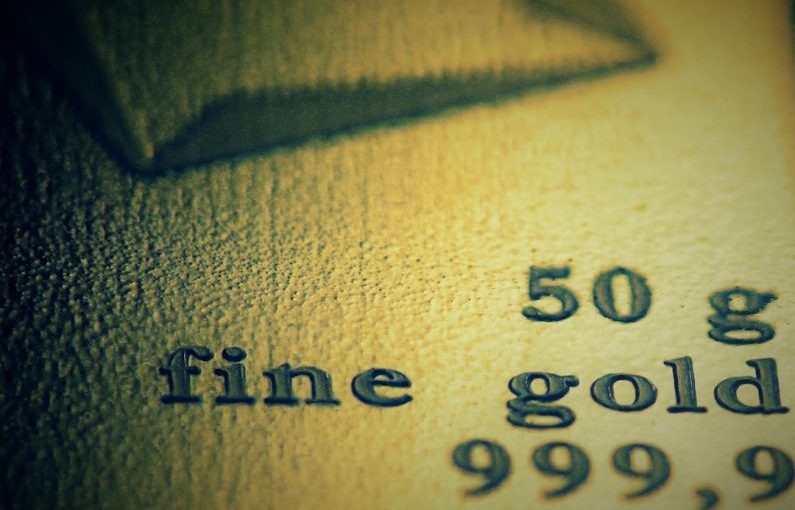

Precious metals are an inflation hedge, meaning that their value tends to rise as the value of the dollar falls. This makes them an attractive option for investors looking to protect their wealth from inflation. Additionally, precious metals are a tangible asset, meaning that they have an intrinsic value that can’t be easily wiped out by market fluctuations.

Precious metals can also help to diversify an investment portfolio. By investing in a range of different metals, investors can spread their risk across different asset classes and benefit from the relative stability that precious metals offer. This can help to reduce the volatility of an investment portfolio and provide investors with greater protection against losses.

How Precious Metals Can Help Strengthen Investment Portfolios

Precious metals can be an effective way to protect and strengthen an investment portfolio. Gold and silver are traditionally viewed as safe-haven investments, meaning that they tend to hold their value even when other markets are suffering. This makes them a great option for investors who are looking to protect their wealth in times of economic uncertainty.

Additionally, precious metals can provide investors with a hedge against currency devaluation. Precious metals are often priced in US Dollars, which can protect investors from fluctuations in the currency market. This makes them a great option for investors looking to protect their wealth from currency devaluation.

Furthermore, precious metals are a great way to diversify an investment portfolio. By investing in different metals, investors can spread their risk and benefit from the stability that precious metals offer. This can help to reduce portfolio volatility and provide investors with greater protection against losses.

Strategies for Investing in Precious Metals

When investing in precious metals, it’s important to have a well-thought-out strategy. Investors should consider the risks and rewards of each type of metal, as well as the costs associated with investing in precious metals.

Investors should also take into account their personal goals and objectives when investing in precious metals. For example, some investors may be looking for a short-term gain, while others may be looking for a long-term investment. Additionally, investors should consider the amount of capital they are willing to invest and the level of risk they are comfortable taking on.

Finally, investors should research the different types of precious metals and their potential returns. This will help them make an informed decision about which type of metal is right for their investment goals.

Investing in precious metals can be a great way to diversify and protect an investment portfolio. Precious metals are a hedge against inflation, help diversify an investment portfolio, and can be a safe-haven in times of economic uncertainty. By having a well-thought-out strategy and researching different metals, investors can be better prepared to make informed decisions about their investments.